At Rodschinson Investment, we aim to provide you with the latest insights so that you can make positive decisions while engaging in real estate development projects.

ROD Development

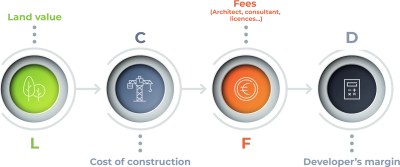

Rodschinson Valuations Explained

FREQUENTLY ASKED QUESTIONS

- How to calculate the market value of a completed asset?

Different approaches are utilized depending on the characteristics of the asset such as:

- Market Comparison approach

- Asset Valuation approach

- Capitalization Rate approach

- Income approach

2. How to discount the developer’s profit?

- It requires forecasting and modeling of the expected sales cycles of the project. The associated cash flows will be discounted at a Discount rate which will be the risk-free cost of capital + risk premium associated with the project.

3. I have a land and I have just applied for building rights, can I use GDV-based valuation?

- No, in this case just getting the right to undergo/pursue the development is a negligible effort compared to the entire development, hence valuation should/must be computed as Land value + cost incurred for application.

Specialists for every situation

Rodschinson Investment is your trusted investement partner to make the smartest possible move whatever is your current situation.

Bastion Tower (level 11-12)

5, Place du Champ de Mars

1050 Brussels, Belgium